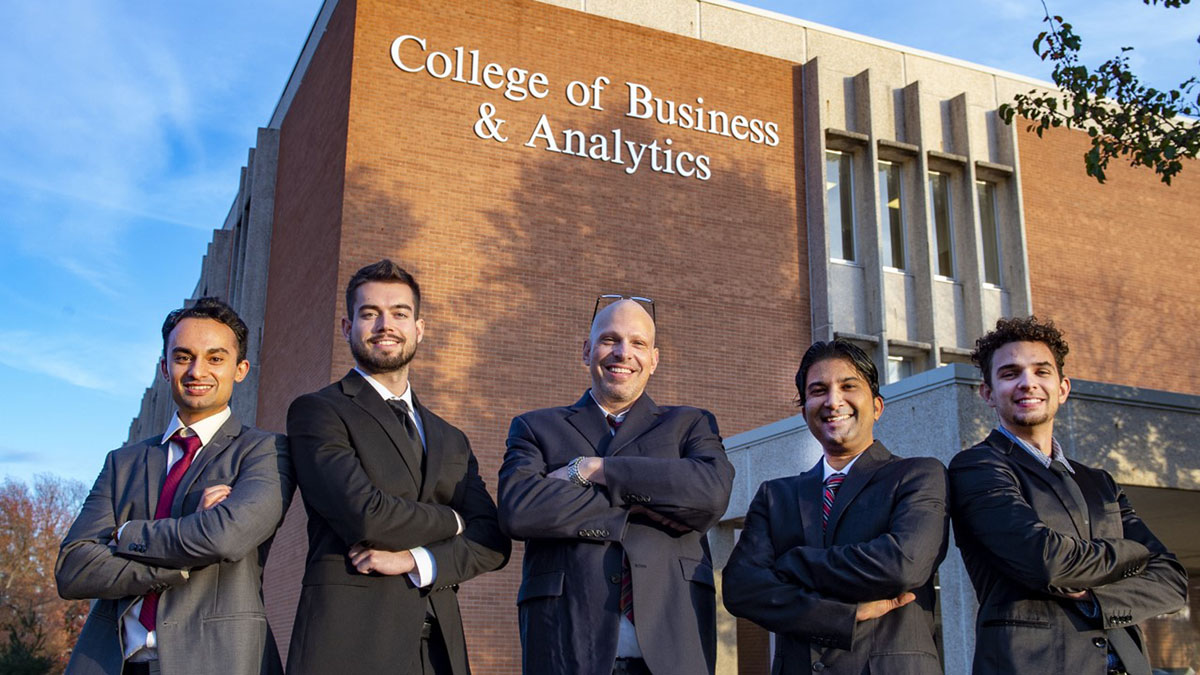

Top traders — Saluki traders, from left to right, Ayush Giri, Adrian Veseli, faculty adviser Ty Perry, Richy John and Rafael Munoz Morales won a top prize in the recent international CME Challenge. (Photo by Russell Bailey)

November 29, 2021

Saluki student traders among top five in international financial trading competition

CARBONDALE, Ill. — In just a month, a team of Southern Illinois University Carbondale graduate students grew $500,000 into $1.25 million and claimed a top prize in an international financial trading competition.

Competing against 385 other teams from around the world, SIU’s “Saluki” traders Ayush Giri, Richy John, Rafael Munoz Morales and Adrian Veseli took fifth place in the CME Group University Trading Challenge. Each team member is a graduate student in the MBA program and each earned his undergraduate degrees at SIU.

Sponsored by the Chicago Mercantile Exchange, the challenge is a monthlong virtual electronic trading competition where students use the same real-time trading futures techniques utilized in the business world.

The finish is SIU’s highest in the prestigious competition and quite an impressive feat, according to Ty Perry, a clinical assistant professor in the School of Analytics, Finance and Economics who serves as the team’s faculty adviser.

“I believe the results of this year’s CME University Trading Challenge confirm the strength of our students and programs on an international scale,” Perry said.

Not an easy feat

Achieving success in this arena is quite difficult, Perry notes. It involves anticipating the direction of future price changes and buying (long) or selling (short) to capture the highest value. It also requires countless hours of research and staying aware of underlying pricing changes.

Undergraduate SIU degrees prepared students

Students can utilize different strategies in the sophisticated virtual competition that resembles operating a real brokerage account, Perry said. While the teams could use futures contracts for agriculture, energy, metals, equity index, interest rates or foreign exchange products, the Salukis chose primarily to focus on oil.

“Our team worked very hard, several hours every day, checking prices, chatting, emailing,” Perry said.

What makes the accomplishment even more remarkable is that the Salukis didn’t have a lot of experience in this particular type of trading.

“Derivative markets have always been fascinating to me, but I have never been directly involved in trading futures and forward contracts,” said Giri, who is from Kathmandu, Nepal. Giri will complete his MBA in finance next month and earned his undergraduate degree in supply chain management.

Perry’s “Options and Futures Markets” class provided a strong foundation in helping prepare the team for the competition, according to John, a native of Bangalore, India. John completed his bachelor’s degree in finance with a specialization in investments in December 2020.

Several team members say they gained invaluable experience by participating in the Saluki Student Investment Fund (SSIF). The registered student organization gives students real-life experience in portfolio management and investment research as they handle a substantial portfolio on behalf of the SIU Foundation.

“The real life experience from SSIF is priceless,” said Veseli, of Oswego, Illinois. “SIU’s finance program is much better than that of rival schools. But, books can only teach you so much,”

“As a member of SSIF I have learned to build valuation models and build both my qualitative and quantitative analytical abilities,” Giri said.

Like his teammates, Morales wasn’t experienced in trading futures, but he jumped at the chance to enhance his knowledge by participating in the competition, especially since it involved “trading a very volatile commodity.”

“It was really hard to decide on our short-term strategy since we knew that only going bullish on oil was not going to be enough to place among the top five in the competition,” said Morales, who is from Valencia, Venezuela. “I learned how to think on my feet and how to look into short-term investments in a different way at SIU. I mostly looked at investments as a long-term deal, so things like candle charts had never caught my attention before. Now, I will be looking into short-term strategies from my personal investments and school-related projects.”

Morales earned his undergraduate degree in finance and is a second semester MBA student.

Learning and doing

Before completing his undergraduate degree in finance in May, Veseli competed in some trading simulators, even winning a couple. But like his fellow MBA Salukis, he found the CME Challenge to be very intense.

Veseli said he spent at least 20 hours each week working on the challenge. Much of the time involved watching crude oil charts, waiting to enter and exit trades, doing fundamental research on the oil markets, staying current on happenings at OPEC meetings and other events that influence oil supply and demand.

The group had active ongoing group chats, held several team ‘huddles’ weekly and worked really hard.

The CME contest is “a highly recognized platform where the brightest business school students participate from the best universities from the United States and the world over,” John said.

“The biggest challenge for us as a team was to revise our trading strategy toward the last 10 days of the game when we got pushed out of the top five 6-7 times,” John said. “That was certainly nerve wracking. At the end, it was truly rewarding that our strategies worked to outplay and outlast the best teams, which testifies to the quality of our faculty, the depth of our programs at SIU and the caliber of Salukis.”

A real nail biter

The contest was tense right down to the wire. Giri noted that their team was in sixth place going into the last day of trading.

“The only way we could break into the top five was to make at least $100,000 that last day,” he said. “We decided to take a calculated risk and we made almost $150k in a single trading day, which helped us break into the top five. All of us were convinced that we needed to take a reasonable risk and all of us stood by this consensus. We also had to be careful that we liquidated all of our position and didn’t overrun our contracts. The final day of the trading was exciting, nerve-wracking and an amazing learning experience.”

By making numerous smart virtual oil trades as well as some wise day trading, the Salukis turned $500,000 into $1,247.598.75. They were just about $35,000 away from fourth place and less than $230,000 away from second place.

“Our performance this year generated a holding period return of almost 250% after the monthlong trading competition ended over the initial seed money given to all teams on day one of trading,” John said.

He expressed appreciation to Perry and others who mentored the Salukis and provided them with a rewarding experience where they came together “as a team believing in inclusive excellence!”

Giri added a “special shout out to our team captain, Adrian, whose patience, knowledge and instinctive skills lifted all of us higher.” and said Perry is “an incredible mentor and all of the other teammates, who were very knowledgeable in their own rights, taught me a lot.”

Each of the winning Salukis earned a $500 prize with their finish.

Career preparation

Participating in the competition and placing in the top five is important for their resumes, according to team members. Each said that their time at SIU has been very rewarding.

Veseli hopes to be a financial analyst and Morales plans a career in the corporate finance world, but he knows banking and other applicable experiences are essential.

“SIU has countless resources that have been helping me achieve my goals,” Morales said. “From the Saluki Student Investment Fund to the help of all of my advisors and professors, I have been able to build the fundamentals of what my future career life will look like.”

Giri anticipates a career in banking, particularly in investment banking. At SIU, he said he has “learned how to analyze business from all its aspects: operations, finance, marketing, accounting and research and development.

Coming to SIU as an older, non-traditional student, John said he found what he needed and more. He returned to school as a full-time student in 2016 after working 11 years for a Fortune 50 British banking conglomerate.

“SIU has played a pivotal role in shaping my goals and directing my career aspirations. As a proud Saluki, I appreciate the opportunity SIU has given me to groom my skills under the top-notch faculty in the College of Business and Analytics,” John said. “The quality of our curriculum and programs has been instrumental in providing me with the resources and the acceptance I needed as a non-traditional student and created a platform for me to engage and collaborate with very talented peers.”

He wants to continue his graduate schooling in finance and pursue a career in academic research.

Another strong SIU finish

A team of undergraduate students from SIU nearly cracked the top 12% in the competition, placing 44th, which is higher than any team has previously placed. That is also quite an accomplishment, Perry said. Members of that team include:

- Luke Dierkes, a sophomore business major from St. Louis, Missouri.

- Joshua Moore, a senior from Pontiac, Illinois, with a double major in economics and finance.

- Joshua Payne, a junior finance major from Carbondale, Illinois.

- Jadrian Wright, a junior accounting major from Hardin County, Illinois.